Day Trading for Beginners

Day trading is trading within one day on the stock market. The strategy represents short-term trades or series of trades with opening and closing without carrying positions over to the next day.

Sharp reactions to any changes and high market volatility are used by traders all over the world to make profits; intraday trading accounts for more than 50% of all transactions on exchanges.

Today you can find a huge amount of information on the Internet about Day Trading for Beginners, and often come across data that are dramatically different from each other. But NEXTCENT will tell you more.

Specifics of Day Trading

This trading technique does not rely on significant price fluctuations, but on a wide variety of price variations. For this reason, the transactions of a trader using the intraday method can be over a hundred.

Unlike many other types of strategies, same-day strategy is more susceptible to market volatility such as news, policy, reports or statistics. The impacts of this and other influences can influence the intraday trader’s mental and psychological well-being.

Stocks chosen for a trade are the ones used in other styles. A differentiation should also be made between high volatility and high liquidity. As a rule, intraday trading involves the use of stocks from leading issuers, different asset futures, as well as currency pairs.

The Beginning of Stock Trading by Day

Inside stock intraday stock trading is performed in stages:

- The opening of a brokerage account – it is worth cooperating with a well-known company;

- Choice of appropriate assets;

- Selection of a trading strategy;

- Execution of trading;

- Fixing the results every day and following the chosen tactics;

- Improvement of your skills in order to get more profits.

If you want to gain maximum income within a trading day, you should choose the most volatile or those assets that are subject to bright trending conditions. Considerable swings promise higher returns.

The Main Instruments of Day Trading

Among them we can distinguish:

- Work with the news stream;

- Technical analysis;

- VSA analysis;

- Scalping.

And now let’s take a closer look at them:

- Trading on the news is very popular and allows reacting to any changes in the world and on specific companies, making purchases and sales of securities in a “wave” or by trend. Traders use certain markers to track news on specific figures in politics and the economy, as well as resources and changes with them.

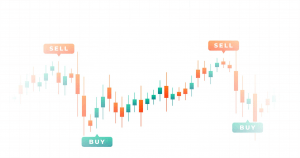

- Technical analysis is used by market professionals and requires serious training to predict trades. Charts, indicators and oscillators, candlesticks, and trading volumes can be taken for a particular asset or industry altogether or in part, which is difficult to handle for intraday trading. Nevertheless, such analysis with a relatively small number of “intraday” trades produces results comparable to other strategies.

- VSA analysis is used by traders who study trading volumes and candlestick charts. It is relatively simple in terms of the amount of data to track but has the peculiarity that it is difficult to react to the received data on time.

- Scalping is one of the most popular and easy-to-manage options for working with securities. Setting a price corridor for buying/selling assets with a small excess from the market price allows frequent daily transactions. For this strategy, the main type of analysis is technical, its graphical part and indicator part.

Advantages of Day Trading

- low entry threshold, which allows for short-term trades and also reduces losses;

- short-term trading with profit taking;

- risk control – a trader monitors his positions most of the time;

- for some traders psychologically it is more comfortable to get small profits often.

For successful trading, it is necessary to determine the analysis tools (charts and indicators), their quantity, as well as the aim of strategy for the future (day, week, month). In any case, the risks in intraday trading are high with a lack of experience, so the speculative nature of deals requires not only practical experience, but also theoretical. Beginner traders can gain such experience with NEXTCENT.

And remember not to worry too much about failure. Open-mindedness is very important for overcoming difficulties that arise on your way. This will help you to succeed in business.

Secrets of Successful Trading

Many people come to the stock market hoping to quickly and effortlessly receive a high stable income. We want to share what success in trading depends on.

There are 3 components of successful trading:

- Basic knowledge of the stock market, knowledge of basic methods of technical analysis, understanding of fundamental analysis, and capital management principles.

- Basic knowledge of Internet trading systems.

- Consistency and psychological stability.

The last one is the most important. Practically any person can master the knowledge and skills of exchange trading. And psychological readiness is not given to everyone.

The reference point of profitability, which one can learn to do in the case of independent trading, is several tens of percent per annum. That is why those who come to the exchange market expecting to multiply their capital by several times quickly should moderate their wishes.

Those satisfied with 15-20% per annum can achieve the desired result without stock trading, using bank deposits, bonds, structured products, and other low-risk investment instruments.