A Beginner’s Guide & Your First Step in Investing in Cryptocurrency

Buying cryptocurrency is a trend that’s been going strong since the past year. What our team will review is how to correctly invest in cryptocurrency for newcomers. We’ ll teach you about secure cryptocurrency holding and the investment risks, and give you tips on which types of cryptocurrencies you should be putting your life savings toward.

Benefits of Cryptocurrency as an Investment

Firstly, have a look at the benefits of this kind of financing. Above all, there are these:

- Liberty of actions – just the wallet owner has control over all transactions with the actives.

- Little required – no specialized expertise or additional effort is needed.

- Centralization – the state can’t monitor virtual currencies.

- Availability.

Cryptocurrency Investment Strategies

After deciding to make an investment in electronic media assets, it is necessary to determine the right market strategy. Some of the choices are as following:

Long-term investing

That’ s a really simple trick, something I also call it: “buy & forget. A man purchases a quantity of crystal currency, then expects its price to increase. Once it has reached the mark that the investor has determined for themselves, that person can sale it.

But to avoid making such an investing scheme a loss, you should put in some spare funds. If you need the cash, you might go into short supply due to its poor value in a given time frame.

Near-term investing

The strategy is appropriate for anyone who does not wish to wait for a considerable period of time to receive a large income from investing. Strategy is broken down into 2 phases: at first, you need to get your capital ready to buy cryptocurrency at a specific time. Afterwards, if its value falls, you should use it to buy some new coins.

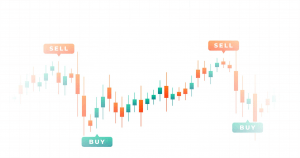

Trading

This option, mostly, is not exactly related to investors, as it takes a lot of work. But it is a potential option of investing in the cryptocurrency, something that might come in useful to newcomers.

Trades means purchasing or selling currencies, whose returns come in the form of regular re-selling: keep trading cheap and sell short. But it requires regular news updates, market rates of cryptocurrency, as much as the overall economy.

In order to succeed in crypto stock trading, you will need to master a few simple abilities and expertise.

These include:

- be able to use the quotes and different graphs;

- how to make trades within the proper time frame;

- understand the trading history;

- comprehend the basic performance of the stock;

- monitor asset selling.

Keep in mind, dealing lets you make a lot faster and better income than traditional investors, although it involves a great deal of extra effort and expertise.

Selection of Currency for Making Investments

Selecting the correct virtual currencies is a complex issue. For our part, what we can propose is to be oriented on the next parameters:

- panelists’ view;

- application area;;

- profitability;

- cost efficiency.

The indicators mentioned just above do not represent the final truth and certainly can come with a far longer criteria sheet.

The following list may serve as guidelines when making a selection:

- Bitcoin;

- Ethereum;

- Litecoin;

- TRON;

- Dogecoin;

- Cardano;

- Stellar;

- Binance Coin.

Each investor, nevertheless, has to rely on their own techniques.

Secure Cryptocurrency Trading

Many services for storage or purchase of currencies exist. In order not to go wrong with it and make the right selection, it is necessary to give attention to this matter as it is.

Tentatively, all cryptocurrency processing tools can be split into two groups: centralized and non-centralized. They are distinguished in the control of transactions involving crystal currency.

In other words, decentralized servers have complete independence and liberty to carry out any transactions, and storing of currencies.

Common types of such services are virtual currency purses.

Centralized authorities are also another option. In a nutshell, they can be referred to as middlemen, as long as they carry out some transactions on the user’s behalf. Such services are cryptocurrencies and stock exchanges, for instance.

Anyway, choosing a service depends on the intended application of the investment strategy. Decentralized systems are ideal for Forex trading, as an example. For long-term investments, however, cryptocurrencies are ideal.

Getting Started in Cryptocurrency Investing Piece by Piece

- In order to do this, follow these steps:

- Determine the crystal currency in that you want to invest in;

- to download and set up a suitable application;

- record the phrase to restore;

- select the preferred amount of desired amount and cryptocurrency;

- pick a provider to make the exchange;

- pin your bank account card.

After all, all you have to do is verify all the operation info and validate.

Investments in Cryptocurrency Risks

An investment in crystal currency, just like every other type of investment, involves risks:

- the volatility of crypto assets;

- risk that a specific virtual currency ceases to be listed or to be listed on the markets;

- unfair treatment by the owners of exchange markets or hacker actions;

- losing secret keys or a phrase for restoration.

Regardless of the risks involved, investing in virtual currency always offers a chance to earn money. The main thing is to think through every step of this process correctly and regularly check your selected policies.

Cryptocurrency Investment Advice for Newbies

You can highlight the tips for the beginner investors as below:

- Be competent in selecting a cryptocurrency to invest in. Here you can choose either a proven digital coin (like bitcoin), or turn your attention to promising cryptocurrencies that are rapidly

- gaining momentum.

- If your budget doesn’t allow you to take on large cryptocurrencies, any other digital currency is a good place to start.

- Follow your plan and strategy.

- Take care to choose a reliable service for cryptocurrency transactions.

- Follow the news and the cryptocurrency market.

Always keep possible risks in mind, take a sober approach to any question related to investments and you will be successful.